Current Income, Diversification and Downside Protection

Current Income, Diversification & Downside Protection via Active Portfolio Management: An Attractive Combination

In the current market environment, investors are faced with the challenge of finding attractive current income solutions that offer protection from rising interest rate risk, particularly as many traditional fixed income strategies (proxy: Bloomberg Barclays Global Agg) have suffered negative monthly returns in recent months. Furthermore, shifts in monetary policy in response to inflationary pressures and uncertainty surrounding the escalating geopolitical crisis in Russia and Ukraine has fuelled bouts of volatility thus far in 2022. To solve for this conundrum, we seek to unearth investment solutions offering higher yields and diversification for Australian investors within the defensive part of their portfolios, and what we view as the more senior, high quality segments of the corporate debt and alternative credit markets; we call it the “sweet spot” of credit. This encompasses a $5.7 trillion1 opportunity set across U.S. and European loans, corporate bonds, and alternative credit markets.

Importantly, we believe a dynamic, flexible approach to investing in the “sweet spot” of credit offers:

- Strong diversification benefits due to varying risk return profiles and low correlation to traditional fixed income and equities

- Opportunity to generate alpha while mitigating risk by shifting targeted exposures through active portfolio management as value shifts between markets, generating attractive entry points into each asset class

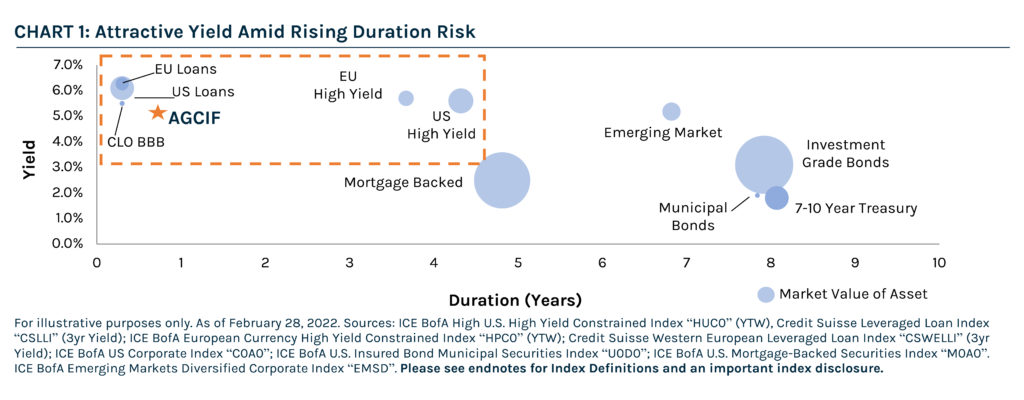

To illustrate the challenges that traditional fixed income investors are facing today, as well as the relative value opportunities available in the corporate debt and alternative credit markets, Chart 1 plots the current yield against interest rate duration for various fixed income asset classes. As elevated dispersion is being driven by duration; our focus remains on targeting asset classes that we believe offer attractive yields without taking excess interest rate risk.

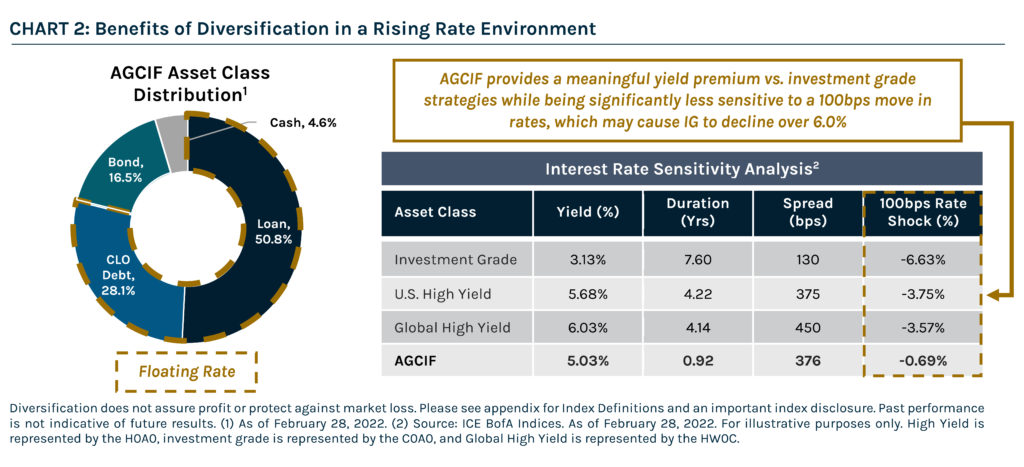

With the outlook of higher interest rates in the months ahead, we believe certain floating rate instruments, specifically bank loans and CLO debt securities, screen attractive from a relative value perspective as they provide stable levels of current income and low duration of less than one year. In a rising rate environment, the coupon of floating rate assets adjusts to shifts in short-term interest rates, and as a result, these assets exhibit lower price volatility relative to fixed rated securities. With almost 80% of the Ares Global Credit Income Fund (“AGCIF” or “the Fund”) invested in floating rate assets today, we believe it is significantly less sensitive to a move in rates, while providing a yield premium vs. investment grade credit, as illustrated in Chart 2.

Across our multi-asset credit portfolios, including AGCIF, we seek to find the most attractive relative value opportunities in the “sweet spot” of credit to deliver higher yields with optimal downside protection and lower volatility. In today’s rapidly evolving market, we believe nimble and active portfolio management remains key to capitalizing on intermittent bouts of volatility, as they often result in attractive, but short-lived entry points. Specific to the Fund, we migrated the portfolio to be overweight floating rate assets in 4Q’21 in anticipation of elevated interest rate risk, which we believe was the right call given the increased volatility and return patterns we’ve seen at the start of 2022. In recent weeks, we have been revisiting bonds following the rates-driven selloff in fixed rate assets during January, as it was viewed as an attractive entry point for high yield relative to loans and CLOs. We believe AGCIF offers protection against interest rate risk and employs an active allocation framework that enables us to capitalize on a divergent opportunity set amid a complex macroeconomic backdrop.

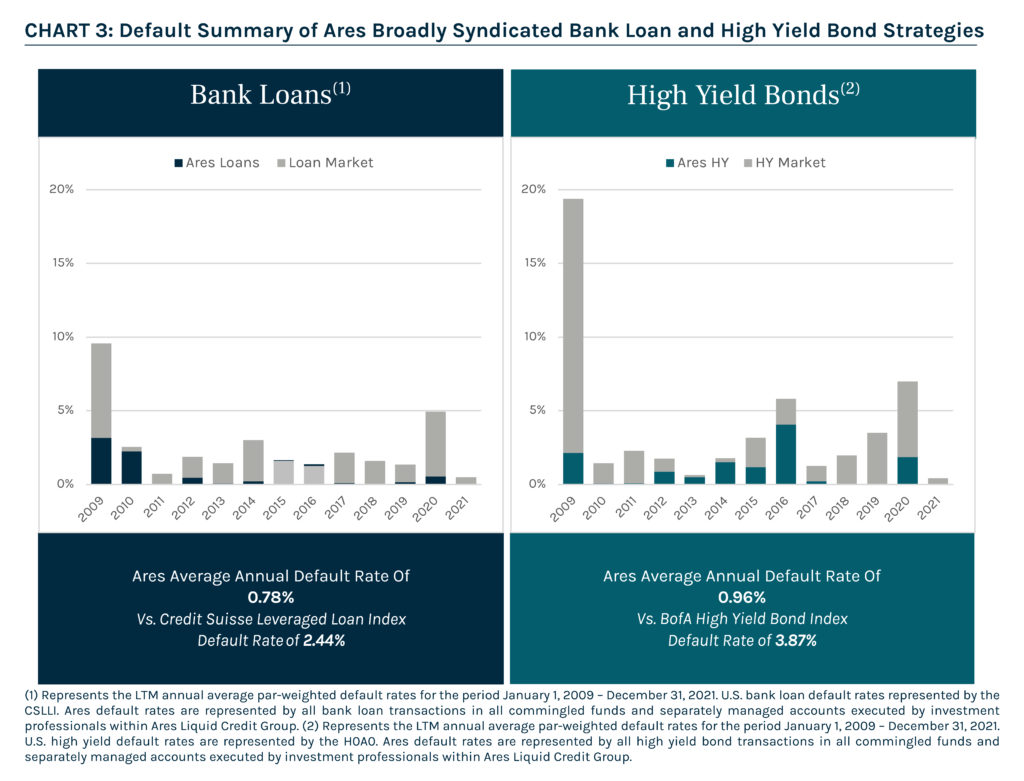

In addition to navigating varied market environments, we will continue to focus on superior credit selection and vigilant risk management in anticipation of elevated dispersion across credit asset classes, industries and issuers throughout 2022. We view the main risks associated with the asset classes in scope to be default risk and price volatility, which is linked to the market expectation of default risk, expressed via credit spreads. Thus, our investment process focuses on capital preservation, predicated on bottom-up fundamental research with the goal of minimizing default risk by identifying and avoiding marginal quality credit. This core tenet of Ares’ investment philosophy has resulted in significantly lower defaults in its bank loan and high yield bond strategies, particularly in periods of dislocation.

In our global multi-asset credit strategies, we seek to capitalise on relative value opportunities with a nimble approach, anchored in attractive levels of current income and a focus on avoiding defaults and dampening volatility. We believe AGCIF is particularly well suited to serve a growing appetite for stable income-producing strategies among Australian investors as it targets a per annum distribution of 3%-4%. Performance for the Fund has benefited from tactical asset allocation and credit selection, as illustrated by its annualized since inception net returns of 7.3%.2 Further, the Fund’s standard deviation over the since inception period is 2.4%, illustrating our keen focus on downside protection and volatility management2.

In summary, as investors seek attractive income solutions in today’s market environment, many may struggle to determine how best to position their credit exposure in an effort to maximize yield and mitigate risk. By accessing the “sweet spot” of credit, comprised of corporate debt and alternative credit asset classes, we believe investors can overcome these challenges. At Ares, our differentiated approach to capitalizing on the best risk-adjusted return opportunities across the investable universe is rooted in the scale and integration of our Global Liquid and Alternative Credit strategies, which allows us to fully leverage extensive research and origination capabilities, proprietary technologies and longstanding relationships.

Teiki Benveniste is Head of Ares Australia Management.

To access the full version, download the PDF

1 Source: CSLLI, Credit Suisse Western European Leveraged Loan Index, ICE BofA US High Yield Index, ICE BofA European Currency High Yield Constrained Index, Bank of America CMBS Research, Ares INsight database, and Intex. As of December 31, 2021. Assumes a 1.13 EUR/USD exchange rate where applicable. Past performance is not indicative of future returns. This article contains the opinions of Ares Liquid Credit Team and is neither an offer to sell, nor the solicitation of an offer to purchase, any security, the offer and/or sale of which can only be made by definitive offering docs. The opinions expressed herein are subject to change without notice. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. All charts, graphs and tables are shown for illustrative purposes only. This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. References to “downside protection” or similar language are not guarantees against loss of investment capital or value. Diversification does not assure profit or protect against market loss. Past performance is not indicative of future results and no representation is made that stated results will be replicated.

2 As of February 28, 2022. Volatility reflects standard deviation.

This article contains the opinions of Ares Liquid Credit Team and is neither an offer to sell, nor the solicitation of an offer to purchase, any security, the offer and/or sale of which can only be made by definitive offering docs. The opinions expressed herein are subject to change without notice. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. All charts, graphs and tables are shown for illustrative purposes only. This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. References to “downside protection” or similar language are not guarantees against loss of investment capital or value. Diversification does not assu re profit or protect against market loss. Past performance is not indicative of future results and no representation is made that stated results will be replicated.

Please see PDF above for Index Disclosure & Definitions