A Short Insight on Opportunities in Alternative Credit

Alternative Credit investments span the liquidity spectrum and are secured by assets that generate cash flows upon which the investment relies for repayment. From an income and yield perspective, these assets offer varying premiums relative to traditional fixed income. These investments also offer downside protection, given ample levels of credit enhancement and robust covenant packages.1

The Opportunity – Relative Value

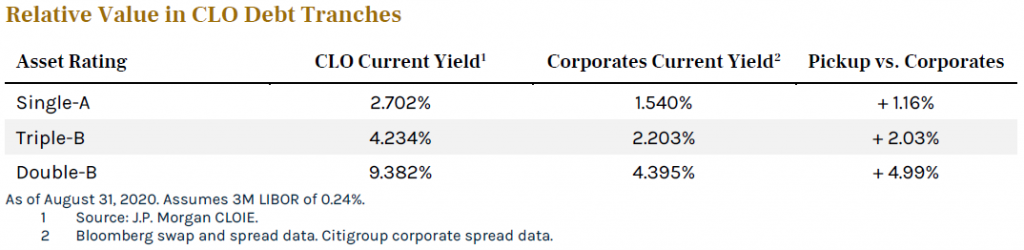

The below chart illustrates the relative value opportunity available to investors in collateralized loan obligations (“CLOs”), an Alternative Credit asset class, relative to similarly rated corporate fixed income.

Insight – CLOs Avoid Most Underlying Corporate Defaults

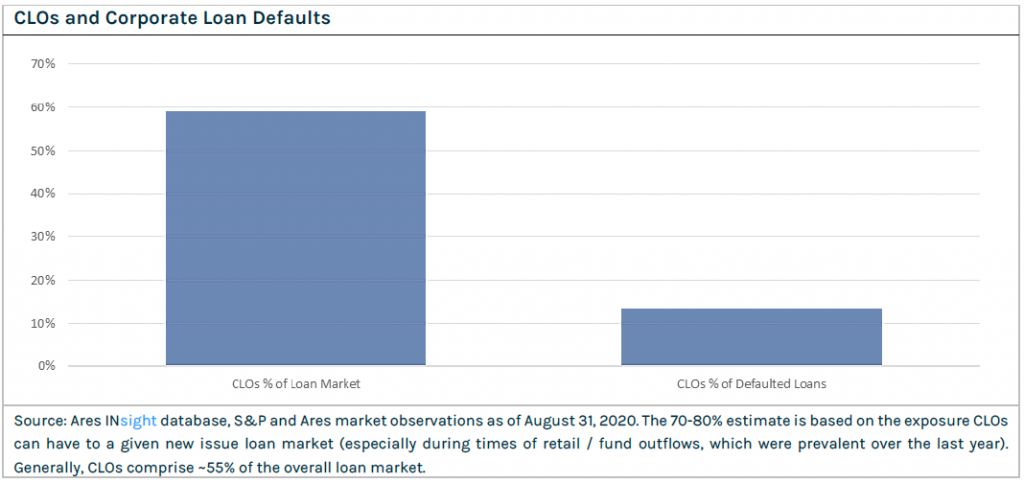

CLOs invest in diversified and actively managed pools of corporate loans. Year-to-date, 59 non-investment grade companies have defaulted on their loans, representing approximately $50 billion of paper. In aggregate, CLOs hold approximately 59% of all corporate loans outstanding. During periods of retail loan fund outflows, CLOs’ share of the primary issue loan market can rise to 75% or more; such has been the case during most of the last 18 months.2

One might therefore expect that CLOs would have been caught holding their fair share (59% or more) of the defaulted issuers. Not so. Per Ares’ proprietary insights, we see that CLOs’ exposure to defaulted loans is 13.3%. Moreover, if we look back in time and ask, “did CLOs ever own these loans which eventually defaulted?” that exposure increases only modestly to 25%.2

This repeats a pattern that we have seen in the CLO market in previous cycles: CLOs have historically had significantly less exposure to the weakest credits than other types of loan funds. At a minimum, it suggests that all the noise around CLOs and their fundamental risks is obscuring some important signals about the nature of this cycle. Why is it again the case that CLOs are underexposed to the weakest credits? The data we see on fundamental credit risks across the loan market suggests that the stronger credit performance that CLOs are experiencing is not a matter of luck but rather credit strategy and investment criteria, albeit with a range across managers.

For additional insights, please visit aresmgmt.com

Disclaimers

The information in this publication is current as at the date of publication and is provided solely by Ares Australia Management Pty Limited (ACN 636 490 732) (AAM). AAM is a corporate authorised representative (no. 1280423) of Fidante Partners Limited (ACN 002 835 592) (AFSL 234668).

AAM is authorised to provide financial services to ‘wholesale clients’ only (within the meaning of the Corporations Act 2001 (Cth)) in Australia. The information in this publication has been provided by AAM on this basis and is for use by such wholesale clients only and no other persons.

The information in this publication is general in nature and has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this publication should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting on the advice. Persons receiving this information should obtain and read any disclosure document relating to any financial product to which the information relates before making any decision about whether to acquire that product.

No reliance: This publication is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The publication has not been independently verified. None of AAM, Ares Management LLC, Fidante Partners Limited, nor any of their respective related bodies corporates, associates and employees, make any republications, warranty or undertaking (express or implied) and accepts no responsibility for the adequacy, accuracy, completeness or reasonableness of the publication or as to the performance of any product. The information contained in the publication does not purport to be complete and is subject to change. No reliance may be placed for any purpose on the publication or its accuracy, fairness, correctness or completeness. None of AAM, Ares Management LLC, Fidante Partners Limited, nor any of their respective related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the publication or otherwise in connection with the publication. Any forward-looking statements in this publication: are made as of the date of such statements; are not guarantees of future performance; and are subject to numerous assumptions, risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. AAM undertakes no obligation to update such statements. Past performance is not a reliable indicator of future performance.

Confidentiality and intellectual property: This publication is confidential and may not be copied, reproduced or redistributed, directly or indirectly, in whole or in part, to any other person in any manner.

Risk: no person guarantees the performance of, or rate of return from, any product or strategy relating to this publication, nor the repayment of capital in relation to an investment in such product or strategy. An investment in any such product or strategy is not a deposit with, nor another liability of, AAM, Ares Management LLC, Fidante Partners Limited nor any of their respective related bodies corporates, associates or employees. Investment in any product or strategy relating to this publication is subject to investment risks, including possible delays in repayment and loss of income and capital invested.

This may contain information obtained from third parties, including ratings from credit ratings agencies such as Standard & Poor’s. Reproduction and distribution of third-party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes and should not be relied on as investment advice.

REF: TCA-00044