Bank Loans: Opportunities Are Knocking

Bank loans present a strong relative value opportunity while providing short duration, stable current income and low defaults

Looking out over the next 12 months, we expect loans to benefit from their safe spread and short duration to generate a full year return of 4-6% – a compelling prospect given the general context of low to negative global interest rates[1].

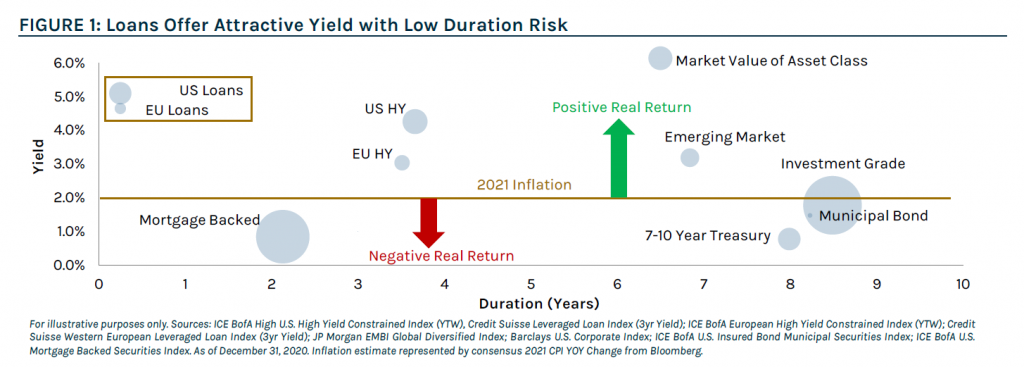

- On a relative value basis versus other asset classes, loans screen even more attractive given their short duration, convexity profile and senior secured spread, illustrated by Figure 1. In addition to the attractive yield, loans offer protection against both potential rising interest rates and a potential stalled recovery given the security of the asset class.

- Furthermore, investment grade is now yielding negative real yields for the first time on record, in conjunction with the longest duration in its history[2].

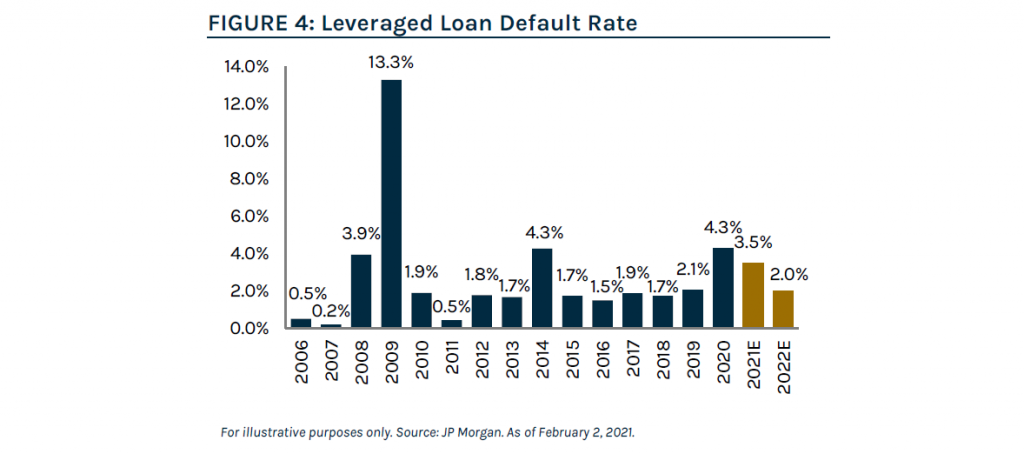

The macro environment remains generally favorable for bank loans this year, with an accommodative Federal Reserve and a high likelihood of additional fiscal stimulus. GDP is expected to grow +5%, and earnings and revenue for the S&P 500 are set to increase 23% and 8%, respectively[3]. Against this backdrop, we believe corporate balance sheets will continue to repair themselves and default rates will trend lower.

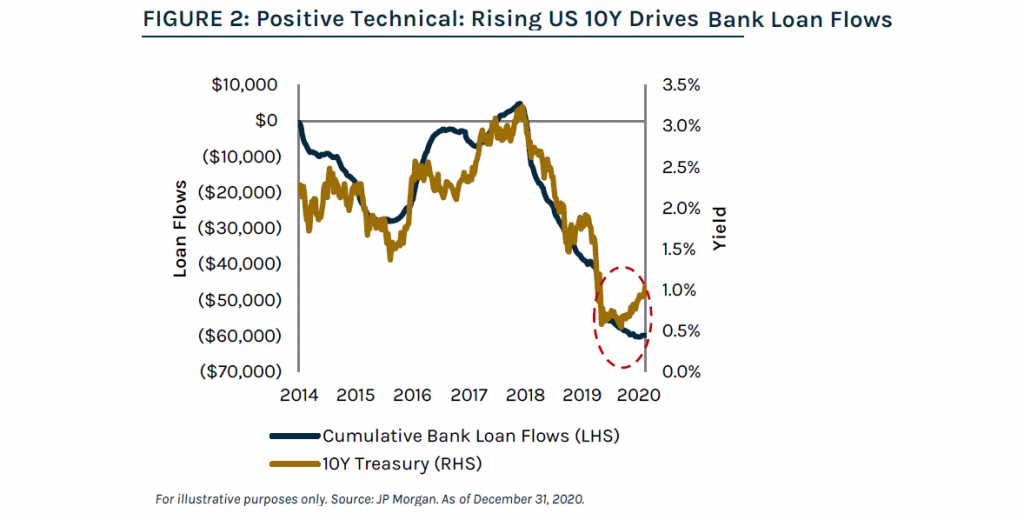

The technical environment should remain supportive as investors begin to rotate into floating rate assets to hedge potential interest rate risk, CLO formation remains strong and global institutional investors continue to search for yield against a modest net new issue supply calendar in 2021.

We believe the Pandemic’s trajectory (vaccine efficacy/new variants/speed of rollout) will be a key driver of the macro environment and credit conditions for bank loans in 2021.We expect the market will continue differentiating between individual credit fundamentals and exacerbate dispersion given the likelihood of an uneven recovery and reopening.

Our view is that security selection will remain critical to generate alpha. Given Ares’ differentiated platform and experience, we believe we are well-equipped to navigate this environment, as demonstrated by our performance over several cycles[4].

Favorable Supply/Demand Technical

Demand for loans is coming from CLOs, retail investors and institutional accounts while organic new supply remains limited.

For 2021, we expect CLO issuance of approximately $100-$110 billion, which compares to $92 billion of issuance in 2020. Our view is based on additional tightening of liabilities, a decent supply pipeline that we believe will give managers sufficient collateral for new deals and an attractive carry opportunity for yield-hungry buyers relative to other securitized products with similar ratings.

Retail mutual funds have seen the largest inflows in years to start this year, and we expect flows to be net positive on the year as the market remains focused on the potential for rising rates (see Figure 2).

Institutional investors are also rotating into floating rate products as a defensive measure against rising rates and tight spreads.

We expect supply to increase only slightly from a total issuance of $311.9 billion in 2020 due to modest LBO/M&A activity thus far in 2021[5].

Improving Fundamentals But with Increased Dispersion

A strengthening macroeconomic scene provides a backdrop for pockets of volatility and increased dispersion within the asset class.

Loan fundamentals, which troughed in Q2 2020, began to rebound in 2H20. For 2021, we expect corporate fundamentals to continue to improve on the back of a macro rebound and related GDP growth, and a return to more normal underlying activity, supported by vaccine dissemination and continued fiscal and monetary support.

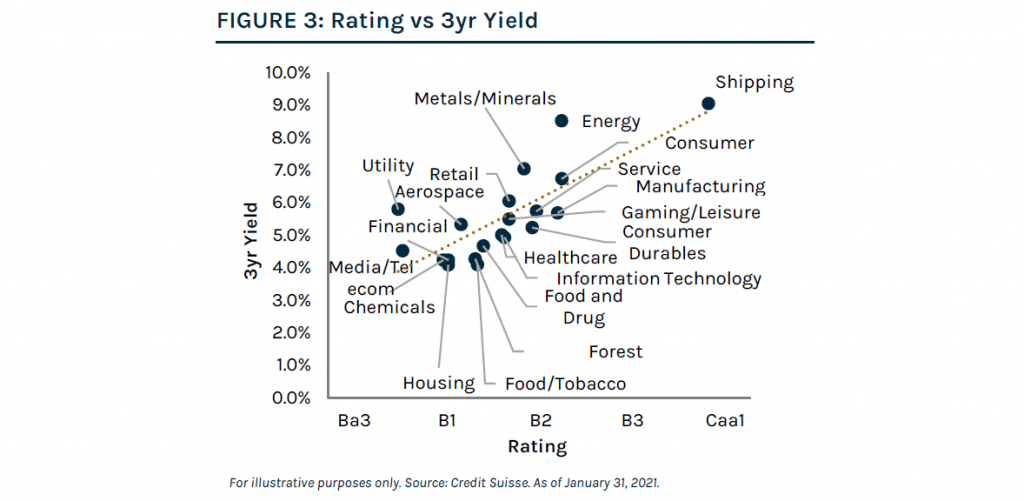

While many companies were able to access capital to manage through COVID-driven lockdowns (and keep the default rate lower than initially anticipated); we remain concerned about the continued viability of certain companies given their new debt loads. We believe this increases the possibility of ‘zombie’ credits in COVID-impacted sectors. This will be a key area to watch this year and into 2022 and underscores the importance of credit selection in a market with elevated dispersion (as shown in Figure 3). We expect the market to shift from beta to alpha opportunities in the coming year.

It is in these types of environments, where we believe credit selection is paramount and loss avoidance is the key to “winning”, that our demonstrated and disciplined investment process and extensive credit platform allow Ares to skillfully navigate this market.

Lower Default Expectations

Default expectations are benign in 2021 and beyond.

Defaults jumped from 2.1% in 2019 to a 5-year high of 4.3% in 2020. Given companies’ ability to access the capital markets throughout the Pandemic, expectations for continued fiscal stimulus and a normalization of macro activity, it is widely forecasted by market participants that the default rate has peaked and will fall to approximately 3.5% in 2021, in line with the historical average, and even lower in 2022.

Conclusion

- With an average price of $96.80 and an average 3-year yield of 4.84%[6], loans offer strong absolute risk-adjusted return opportunities and look attractive compared to other fixed income alternatives which have much longer duration. We do not expect front end rates to rise in the near term; however, we expect loans to perform well in 2021 on an absolute and relative basis compared to other fixed income asset classes and provide a hedge for investors looking to protect themselves from a rising rate environment and a steepening rate curve.

- We believe attractive opportunities abound within the loan asset class today and expect the asset class to deliver returns of 4-6% to investors in 2021. However, we expect the recovery to be uneven and anticipate an elevated level of idiosyncratic credit events looking into 2H21 and beyond.We believe a manager skilled at bottom-up credit selection, able to construct portfolios using a top-down overlay of macro factors and capable of tactically allocating a portfolio based on relative value is necessary to outperform.

Authored by

Jason Duko, Portfolio Manager of U.S. Liquid Credit | Samantha Milner, Portfolio Manager of U.S. Liquid Credit | Michael Schechter, Head of Credit Trading | Ruben Valverde, Ares Quantitative Risk & Research Team | Julie Greenman, Global Liquid Credit Product Management & Investor Relations | Florina Yang, Global Liquid Credit Product Management & Investor Relations

[1] Source: JPM. As of November 24, 2020.

[2] Source: Goldman Sachs. As of February 2, 2021.

[3] FactSet. As of January 29, 2021.

[4] Note: Past performance is not indicative of future results.

[5] Source: JPM Morning Intelligence. As of December 31, 2020.

[6] Source: Credit Suisse. As of January 31, 2021.

Index Definitions

Credit Suisse Leveraged Loan Index (“US Loans) is designed to mirror the investable universe of the $US-denominated leveraged loan market. The index inception is January 1992. The index frequency is daily, weekly and monthly. New loans are added to the index on their effective date if they qualify according to the following criteria: 1) Loan facilities must be rated “5B” or lower. That is, the highest Moody’s/S&P ratings are Baa1/BB+ or Ba1/BBB+. If unrated, the initial spread level must be Libor plus 125 basis points or higher. 2) Only fully-funded term loan facilities are included. 3) The tenor must be at least one year. 4) Issuers must be domiciled in developed countries; issuers from developing countries are excluded.

Credit Suisse Western European Leveraged Loan Index (“EU Loans”) is designed to mirror the investable universe of the leveraged loan market of issues which are denominated in US$ or Western European currencies. The issuer has assets located in or revenues derived from Western Europe, or the loan represents assets in Western Europe, such as a loan denominated in a Western European currency. Loan facilities must be rated “5B” or lower. That is, the highest Moody’s/S&P ratings are Baa1/BB+ or Ba1/BBB+. Only fully funded term loan facilities are included and the tenor must be at least one year. Minimum outstanding balance is $100 million and new loans must be priced by a third-party vendor at month-end. The index inception is January 1998.

The ICE BofA U.S. High Yield Constrained Index (“US HY”) is a market-value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issues included in the index have maturities of one year or more and have a credit rating lower than BBB-/Baa3 but are not in default. The ICE BofAML U.S. High Yield Constrained Index limits any individual issuer to a maximum of 2% benchmark exposure.

The ICE BofA European Currency High Yield Constrained Index (“EU HY”) tracks the performance of EUR and GBP denominated below investment grade corporate debt publicly issued in the eurobond, sterling domestic or euro domestic markets. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of EUR 250 million or GBP 100 million. Original issue zero coupon bonds and pay-in-kind securities, including toggle notes, qualify for inclusion in the Index. Callable perpetual securities qualify provided they are at least one year from the first call date. Fixed-to-floating rate securities also qualify provided they are callable within the fixed rate period and are at least one year from the last call prior to the date the bond transitions from a fixed to a floating rate security. Contingent capital securities (“cocos”) are excluded, but capital securities where conversion can be mandated by a regulatory authority, but which have no specified trigger, are included. Other hybrid capital securities, such as those issues that potentially convert into preference shares, those with both cumulative and non-cumulative coupon deferral provisions, and those with alternative coupon satisfaction mechanisms, are also included in the index. Equity-linked securities, securities in legal default and hybrid securitized corporates are excluded from the index.

The Bloomberg Barclays U.S. Corporate Bond Index (“Investment Grade”) is an unmanaged market-value-weighted index of investment-grade corporate fixed-rate debt issues with maturities of one year or more.

The BofA Merrill Lynch Constrained Duration U.S. Mortgage Backed Securities Index (“Mortgage Backed”) tracks the performance of U.S. dollar denominated 30-year, 20-year, and 15-year fixed rate residential mortgage pass-through securities publicly issued by U.S. agencies in the U.S. domestic market.

The J.P. Morgan Global Aggregate Bond Index (“Emerging Market”) consists of the JPM GABI US, a U.S. dollar denominated, investment-grade index spanning asset classes from developed to emerging markets, and the JPM GABI extends the U.S. index to also include multi-currency, investment-grade instruments. Launched in November 2008, the JPM GABI represents nine distinct asset classes: Developed Market Treasuries, Emerging Market Local Treasuries, Emerging Markets External Debt, Emerging Markets Credit, US Credit, Euro Credit, US Agencies, US MBS, Pfandbriefe – represented by well-established J.P. Morgan indices. The JPM GABI US is constructed from over 3,200 instruments issued from over 50 countries, and collectively represents US$8.6 trillion in market value. The JPM GABI is constructed from over 5,500 instruments issued from over 60 countries and denominated in over 25 currencies, collectively representing US$20 trillion in market value.

The ICE BofA U.S. Municipal Securities Index (“Municipal Bond”) tracks the performance of the investment-grade U.S. tax-exempt bond market. Qualifying bonds must have at least one year remaining term to maturity, a fixed coupon schedule, and an investment grade rating (based on average of Moody’s, S&P, and Fitch).

Disclaimer

These materials are neither an offer to sell, nor the solicitation of an offer to purchase, any security, the offer and/or sale of which can only be made by definitive offering documentation. Any offer or solicitation with respect to any securities that may be issued by any investment vehicle (each, an “Ares Fund”) managed or sponsored by Ares Management LLC or any of its subsidiary or other affiliated entities (collectively, “Ares Management”) will be made only by means of definitive offering memoranda, which will be provided to prospective investors and will contain material information that is not set forth herein, including risk factors relating to any such investment. Any such offering memoranda will supersede these materials and any other marketing materials (in whatever form) provided by Ares Management to prospective investors. In addition, these materials are not an offer to sell, or the solicitation of an offer to purchase securities of Ares Management Corporation (“Ares Corp”), the parent of Ares Management. An investment in Ares Corp is discrete from an investment in any fund directly or indirectly managed by Ares Corp. Collectively, Ares Corp, its affiliated entities, and all underlying subsidiary entities shall be referred to as “Ares” unless specifically noted otherwise. Certain Ares Fund securities may be offered through our affiliate, Ares Investor Services LLC (“AIS”), a broker-dealer registered with the SEC, and a member of FINRA and SIPC.

In making a decision to invest in any securities of an Ares Fund, prospective investors should rely only on the offering memorandum for such securities and not on these materials, which contain preliminary information that is subject to change and that is not intended to be complete or to constitute all the information necessary to adequately evaluate the consequences of investing in such securities. Ares makes no representation or warranty (express or implied) with respect to the information contained herein (including, without limitation, information obtained from third parties) and expressly disclaims any and all liability based on or relating to the information contained in, or errors or omissions from, these materials; or based on or relating to the recipient’s use (or the use by any of its affiliates or representatives) of these materials; or any other written or oral communications transmitted to the recipient or any of its affiliates or representatives in the course of its evaluation of Ares or any of its business activities. Ares undertakes no duty or obligation to update or revise the information contained in these materials.

The recipient should conduct its own investigations and analyses of Ares and the relevant Ares Fund and the information set forth in these materials. Nothing in these materials should be construed as a recommendation to invest in any securities that may be issued by Ares Corp or an Ares Fund or as legal, accounting or tax advice. Before making a decision to invest in any Ares Fund, a prospective investor should carefully review information respecting Ares and such Ares Fund and consult with its own legal, accounting, tax and other advisors in order to independently assess the merits of such an investment.

These materials are not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation.

These materials contain confidential and proprietary information, and their distribution or the divulgence of any of their contents to any person, other than the person to whom they were originally delivered and such person’s advisors, without the prior consent of Ares is prohibited. The recipient is advised that United States securities laws restrict any person who has material, nonpublic information about a company from purchasing or selling securities of such company (and options, warrants and rights relating thereto) and from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities. The recipient agrees not to purchase or sell such securities in violation of any such laws, including of Ares Corp or a publicly traded Ares Fund.

These materials may contain “forward-looking” information that is not purely historical in nature, and such information may include, among other things, projections, forecasts or estimates of cash flows, yields or returns, scenario analyses and proposed or expected portfolio composition. The forward-looking information contained herein is based upon certain assumptions about future events or conditions and is intended only to illustrate hypothetical results under those assumptions (not all of which will be specified herein). Not all relevant events or conditions may have been considered in developing such assumptions. The success or achievement of various results and objectives is dependent upon a multitude of factors, many of which are beyond the control of Ares. No representations are made as to the accuracy of such estimates or projections or that such projections will be realized. Actual events or conditions are unlikely to be consistent with, and may differ materially from, those assumed. Prospective investors should not view the past performance of Ares as indicative of future results. Ares does not undertake any obligation to publicly update or review any forward-looking information, whether as a result of new information, future developments or otherwise.

Some funds managed by Ares or its affiliates may be unregistered private investment partnerships, funds or pools that may invest and trade in many different markets, strategies and instruments and are not subject to the same regulatory requirements as mutual funds, including mutual fund requirements to provide certain periodic and standardized pricing and valuation information to investors. Fees vary and may potentially be high.

These materials also contain information about Ares and certain of its personnel and affiliates whose portfolios are managed by Ares or its affiliates. This information has been supplied by Ares to provide prospective investors with information as to its general portfolio management experience. Information of a particular fund or investment strategy is not and should not be interpreted as a guaranty of future performance. Moreover, no assurance can be given that unrealized, targeted or projected valuations or returns will be achieved. Future results are subject to any number of risks and factors, many of which are beyond the control of Ares. In addition, an investment in one Ares Fund will be discrete from an investment in any other Ares Fund and will not be an investment in Ares Corp. As such, neither the realized returns nor the unrealized values attributable to one Ares Fund are directly applicable to an investment in any other Ares Fund. An investment in an Ares Fund (other than in publicly traded securities) is illiquid and its value is volatile and can suffer from adverse or unexpected market moves or other adverse events. Funds may engage in speculative investment practices such as leverage, short-selling, arbitrage, hedging, derivatives, and other strategies that may increase investment loss. Investors may suffer the loss of their entire investment. In addition, in light of the various investment strategies of such other investment partnerships, funds and/or pools, it is noted that such other investment programs may have portfolio investments inconsistent with those of the strategy or investment vehicle proposed herein.

This may contain information obtained from third parties, including ratings from credit ratings agencies such as Standard & Poor’s. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice.

This may contain information sourced from Bank of America, used with permission. BANK OF AMERICA IS LICENSING THE ICE BOFA INDICES AND RELATED DATA “AS IS,” MAKES NO WARRANTIES REGARDING SAME, DOES NOT GUARANTEE THE SUITABILITY, QUALITY, ACCURACY, TIMELINESS, AND/OR COMPLETENESS OF THE ICE BOFA INDICES OR ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM, ASSUMES NO LIABILITY IN CONNECTION WITH THEIR USE, AND DOES NOT SPONSOR, ENDORSE, OR RECOMMEND ARES MANAGEMENT, OR ANY OF ITS PRODUCTS OR SERVICES.

REF: TC-02037

Disclaimer – Fidante Partners

Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante) has entered into arrangements with Ares and Ares Australia Management Pty Ltd ABN 51 636 490 732 (AAM), in connection with the distribution and administration of financial products managed by Ares or AAM. In connection with those arrangements, Fidante or AAM may receive remuneration or other benefits in respect of financial services provided by the parties. Neither Fidante nor AAM are responsible for the information in this material, including any statements of opinion. AAM is an Authorised Representative No. 001280423 of Fidante and is in the process of seeking its own Australian financial services licence.

Ares is exempt from the requirement to hold an Australian Financial Services Licence. Ares is subject to regulation by the Securities & Exchange Commission of the United States of America under US laws, which differ from Australian laws. None of Ares Australia Management Pty Limited, Fidante Partners Limited, nor any of their associates, has prepared the information in this publication and accept no liability whatsoever in relation to it. This publication is only made available to ‘wholesale clients’ or ‘sophisticated investors’ under the Corporations Act 2001 (Cth) in Australia.