Index Definitions and Disclosure

March 2022

- The Credit Suisse Western European Leveraged Loan Index (“CSWELLI”) is designed to mirror the investable universe of the leveraged loan market of issues which are denominated in US$ or Western European currencies. The issuer has assets located in or revenues derived from Western Europe, or the loan represents assets in Western Europe, such as a loan denominated in a Western European currency. Loan facilities must be rated “5B” or lower. That is, the highest Moody’s/S&P ratings are Baa1/BB+ or Ba1/BBB+. Only fully funded term loan facilities are included and the tenor must be at least one year. Minimum outstanding balance is $100 million and new loans must be priced by a third-party vendor at month-end. The index inception is January 1998.

- The Credit Suisse Institutional Leveraged Loan Index (“CSLLI”) is designed to mirror the investable universe of the $US-denominated leveraged loan market. The index inception is January 1992. The index frequency is daily, weekly and monthly. New loans are added to the index on their effective date if they qualify according to the following criteria: 1) Loan facilities must be rated “5B” or lower. That is, the highest Moody’s/S&P ratings are Baa1/BB+ or Ba1/BBB+. If unrated, the initial spread level must be Libor plus 125 basis points or higher. 2) Only fully-funded term loan facilities are included. 3) The tenor must be at least one year. 4) Issuers must be domiciled in developed countries; issuers from developing countries are excluded.

- ICE BofA European Currency High Yield Constrained Index (“HPC0”) tracks the performance of EUR and GBP denominated below investment grade corporate debt publicly issued in the eurobond, sterling domestic or euro domestic markets. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of EUR 250 million or GBP 100 million. Original issue zero coupon bonds and pay-in-kind securities, including toggle notes, qualify for inclusion in the Index. Callable perpetual securities qualify provided they are at least one year from the first call date. Fixed-to-floating rate securities also qualify provided they are callable within the fixed rate period and are at least one year from the last call prior to the date the bond transitions from a fixed to a floating rate security. Contingent capital securities (“cocos”) are excluded, but capital securities where conversion can be mandated by a regulatory authority, but which have no specified trigger, are included. Other hybrid capital securities, such as those issues that potentially convert into preference shares, those with both cumulative and non-cumulative coupon deferral provisions, and those with alternative coupon satisfaction mechanisms, are also included in the index. Equity-linked securities, securities in legal default and hybrid securitized corporates are excluded from the index. Inception date: December 31, 1997.

- The BofA US High Yield Master II Constrained Index (“HUC0”) tracks the performance of US Dollar denominated below investment grade corporate debt publicly issued in the US domestic market with a maximum issuer exposure of 2%. The returns of the benchmark are provided to represent the investment environment existing during the time period shown. For comparison purposes the index includes the reinvestment of income and other earnings but does not include any transaction costs, management fees or other costs. BANK OF AMERICA IS LICENSING THE ICE BofA INDICES AND RELATED DATA “AS IS,” MAKES NO WARRANTIES REGARDING SAME, DOES NOT GUARANTEE THE SUITABILITY, QUALITY, ACCURACY, TIMELINESS, AND/OR COMPLETENESS OF THE ICE BofA INDICES OR ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM, ASSUMES NO LIABILITY IN CONNECTION WITH THEIR USE, AND DOES NOT SPONSOR, ENDORSE, OR RECOMMEND ARES MANAGEMENT, OR ANY OF ITS PRODUCTS OR SERVICES.

- ICE BofA US Corporate Index (“C0A0”) tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have an investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million. Original issue zero coupon bonds, 144a securities (with and without registration rights), and pay-in-kind securities (including toggle notes) are included in the index. Callable perpetual securities are included provided they are at least one year from the first call date. Fixed-to-floating rate securities are included provided they are callable within the fixed rate period and are at least one year from the last call prior to the date the bond transitions from a fixed to a floating rate security. Contingent capital securities (“cocos”) are excluded, but capital securities where conversion can be mandated by a regulatory authority, but which have no specified trigger, are included. Other hybrid capital securities, such as those issues that potentially convert into preference shares, those with both cumulative and non-cumulative coupon deferral provisions, and those with alternative coupon satisfaction mechanisms, are also included in the index. Equity-linked securities, securities in legal default, hybrid securitised corporates, Eurodollar bonds (USD securities not issued in the US domestic market), taxable and tax-exempt US municipal securities and DRD-eligible securities are excluded from the index. Index constituents are market capitalisation weighted. Accrued interest is calculated assuming next-day settlement. Cash flows from bond payments that are received during the month are retained in the index until the end of the month and then are removed as part of the rebalancing. Cash does not earn any reinvestment income while it is held in the index. Information concerning constituent bond prices, timing and conventions is provided in the ICE BofA Bond Index Guide, which can be accessed on our public website (www.mlindex.ml.com), or by sending a request to [email protected]. The index is rebalanced on the last calendar day of the month, based on information available up to and including the third business day before the last business day of the month. New issues must settle on or before the calendar month end rebalancing date in order to qualify for the coming month. No changes are made to constituent holdings other than on month end rebalancing dates. Inception date: December 31, 1972.

- JPM U.S. CLOIE BBB Post-Global Financial Crisis Index tracks floating-rate CLO securities in 2004-present vintages, rated BBB. Additional sub-indices are divided by ratings AAA through BB, and further divided between pre- and post-crisis vintages. CLO 2.0, or post-crisis vintages, include deals issued in 2010 and later. CLOIE utilizes a market-value weighted methodology. Inception date: July 15, 2014.

- ICE BofA U.S. Mortgage Backed Securities Index (“M0A0”) tracks the performance of US dollar denominated 30-year, 20-year and 15-year fixed rate residential mortgage pass-through securities publicly issued by US agencies in the US domestic market. Fixed rate mortgage pools are included in the Index provided they have at least one year remaining term to final maturity and a minimum amount outstanding of at least $5 billion per generic coupon. Balloon, mobile home, graduated payment and quarter coupon fixed rate mortgages are excluded from the index, as are all collateralized mortgage obligations.

- ICE BofA 7-10 Year US Treasury Index is a subset of ICE BofA US Treasury Index including all securities with a remaining term to final maturity greater than or equal to 7 years and less than 10 years. ICE BofA US Treasury Index tracks the performance of US dollar denominated sovereign debt publicly issued by the US government in its domestic market. Qualifying securities must have at least one year remaining term to final maturity, a fixed coupon schedule and a minimum amount outstanding of $1 billion. Qualifying securities must have at least 18 months to final maturity at the time of issuance. Callable perpetual securities qualify provided they are at least one year from the first call date. Fixed-to-floating rate securities also qualify provided they are callable within the fixed rate period and are at least one year from the last call prior to the date the bond transitions from a fixed to a floating rate security. Bills, inflation-linked debt and strips are excluded from the Index; however, original issue zero coupon bonds are included in the index and the amounts outstanding of qualifying coupon securities are not reduced by any portions that have been stripped. Securities issued or marketed primarily to retail investors do not qualify for inclusion in the index. Inception date: March 31, 1973

- ICE BofA US Insured Bond Municipal Securities Index (U0D0) is a subset of ICE BofA US Municipal Securities Index including all insured securities. CE BofA US Municipal Securities Index tracks the performance of US dollar denominated investment grade tax-exempt debt publicly issued by US states and territories, and their political subdivisions, in the US domestic market. Qualifying securities must have at least one year remaining term to final maturity, at least 18 months to final maturity at the time of issuance, a fixed coupon schedule and an investment grade rating (based on an average of Moody’s, S&P and Fitch). Minimum size requirements vary based on the initial term to final maturity at time of issuance. Securities with an initial term to final maturity greater than or equal to one year and less than five years must have a current amount outstanding of at least $10 million. Securities with an initial term to final maturity greater than or equal to five years and less than ten years must have a current amount outstanding of at least $15 million. Securities with an initial term to final maturity of ten years or more must have a current amount outstanding of at least $25 million. The call date on which a pre-refunded bond will be redeemed is used for purposes of determining qualification with respect to final maturity requirements. Mandatory put or mandatory tender securities and original issue zero coupon bonds are included in the Index. Limited offering securities only qualify for inclusion in the U.S. municipal indices after their first settlement date are also included in the index. All secondarily insured securities, taxable municipal securities, 144a securities, securities in legal default and securities issued under the Municipal Liquidity Facility or a municipal commercial paper program are excluded from the Index. Inception date: December 31, 1988

- ICE BofA Emerging Markets Diversified Corporate Index (EMSD) racks the performance of US dollar denominated emerging markets corporate senior and secured debt publicly issued in the US domestic and eurobond markets. In order to qualify for inclusion in the Index an issuer must have primary risk exposure to a country other than a member of the FX G10, a Western European country, or a territory of the US or a Western European country. The FX-G10 includes all Euro members, the US, Japan, the UK, Canada, Australia, New Zealand, Switzerland, Norway and Sweden. Individual securities of qualifying issuers must be denominated in US dollars, must be senior or secured debt, must have at least one year remaining term to final maturity a fixed coupon and at least $500 million in outstanding face value. Qualifying securities must have at least 18 months to final maturity at the time of issuance. The index includes corporate debt of qualifying countries, but excludes sovereign, quasi-government, securitized and collateralized debt. Original issue zero coupon bonds 144a securities, both with and without registration rights, and pay-in-kind securities, including toggle notes, qualify for inclusion in the Index. Callable perpetual securities qualify provided they are at least one year from the first call date. Fixed-to-floating rate securities also qualify provided they are callable within the fixed rate period and are at least one year from the last call prior to the date the bond transitions from a fixed to a floating rate security. Securities rated Ca/CC or lower by any of the three rating agencies do not qualify for inclusion. Contingent capital securities (“cocos”) are excluded, but capital securities where conversion can be mandated by a regulatory authority, but which have no specified trigger, are included. Other hybrid capital securities, such as those issues that potentially convert into preference shares, those with both cumulative and non-cumulative coupon deferral provisions, and those with alternative coupon satisfaction mechanisms, are also included in the index. Securities issued or marketed primarily to retail investors do not qualify for inclusion in the index. Equity-linked securities, securities in legal default and hybrid securitized corporates are excluded from the index.

US Direct Lending yield and duration is reflected by Ares Capital Corporation’s “ARCC”. Yield reflects the weighted average yield on debt and income producing securities at amortized cost. The weighted average yield on debt and other income producing securities is computed as (a) annual stated interest rate or yield earned plus the net annual amortization of original issue discount and market discount or premium earned on accruing debt and other income producing securities (including the annualized amount of the dividend received by Ares Capital related to its equity investment in IHAM during the most recent quarter end), divided by (b) total accruing debt and other income producing securities at amortized cost or at fair value (including the amortized cost or fair value of Ares Capital’s equity investment in IHAM as applicable), as applicable. Duration reflects 3-Month LIBOR.

Endnotes

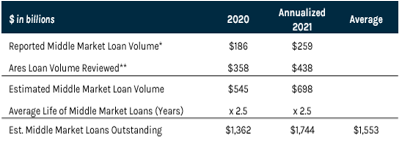

US Direct Lending market size is sourced by Ares. Based on Ares’ own data calculations using information from Refinitiv, S&P Global Market Intelligence and Ares’ own observations. Addressable market based on the average of 2020 and 1H21 annualized deal volume and a 2.5 year life assumption. *Reported Middle Market Loan Volume: Represents reported middle market loan volume per Refinitiv middle market reported deals and S&P Global Market Intelligence reported deals with less than $750 million tranche size, excluding duplicates between the two sources (assumed to be 10% based on Ares’ observations).

**Ares Loan Volume Reviewed: Represents estimated loan volume reviewed by Ares U.S. Direct Lending platform based on the following information and assumptions: (a) the total volume reviewed by Ares’ U.S. Direct Lending platform equals the product of the number of transactions in the pipeline for a given period, the average EBITDA of transactions in the pipeline for the given period, and the average senior debt to EBITDA of middle market transactions per Refinitiv for the given period and (b) the amount calculated in (a) above has been adjusted to exclude transaction volume also reported to S&P Global and Refinitiv (assumed to be 25% based on Ares’ observations) and transaction volume that was not closed either by Ares or the broader market (assumed to be 10% base on Ares’ observations).