Rethinking Income: Where to Find Higher Yields with Stability

The following article was first published on 30 July 2020 and featured in Livewire’s Income Series 2020.

Coming into 2020, income investors had been on a “hunt for yield” due to low interest rates globally. Fast forward to the present and the search for income has only intensified as the COVID-19 pandemic has shaped investor sentiment and pushed government and traditional fixed income yields below one percent, and in some cases into negative territory1. Additionally, traditional sources of income, such as dividend-paying equities, have become a less reliable source of income during this period.Against this backdrop, we believe investors should think outside the box and look beyond traditional asset classes for income. We believe the credit markets provide multiple sources of alternative income for investors due to their historically attractive yields, defensive structures and historical risk-return profile. In this piece, we will examine alternative income solutions in today’s credit markets and their role in an investor’s portfolio.

Sources of Alternative Income

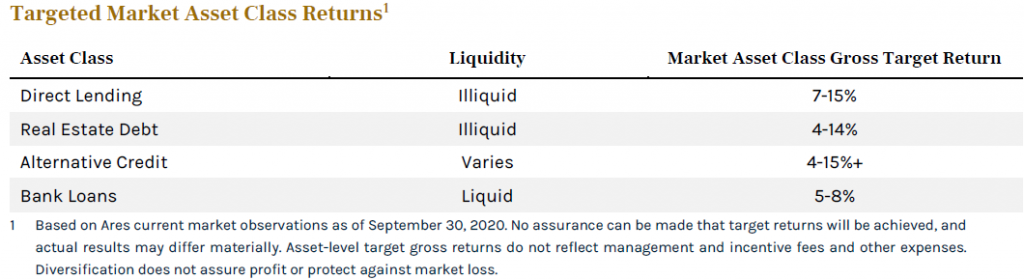

There are various opportunities within the credit markets that we view as alternative sources of income. They span the liquidity spectrum, and total returns are typically driven by income. The yields on these asset classes are generally priced at a premium to traditional fixed income due to factors such as credit risk and liquidity. These alternative asset classes can be viewed as a more reliable source of income compared to traditional public equities as the current income component is contractual.

Alternative Income Universe

Corporate Direct Lending (“Direct Lending”): A transaction where a lending source directly provides a loan to the borrower without the use of an intermediary. This is accomplished by directly engaging with private equity sponsors or owner/operators of middle market companies (generally $10 – $150 million of EBITDA or greater) to originate loans. As the asset class has evolved, select managers have been able to execute larger transactions which overlap with the broadly syndicated market.

Illustrative Example: Direct Lending

A private equity firm seeks financing to support their buyout of a market leading software company. The target company provides mission-critical products and has a global, diversified customer base with strong retention rates. The acquisition occurs during a period of elevated market volatility, and sentiment across public and private markets is risk averse. To finance the transaction, the private equity firm approaches an alternative investment manager (the “manager”) with a scaled, experienced direct lending business. The manager has supported the target company historically and has in-depth knowledge of their business model. Additionally, the manager has sufficient assets under management such that it is able to underwrite risk during a period of elevated volatility. Due to market conditions, the manager can negotiate enhanced pricing and tighter documentation as compared to its prior deals with the target company. As such, the private equity firm can execute on its buyout of the software company while the manager is able to finance the company and provide its investors with an attractive, defensively structured source of current income.

Commercial Real Estate First Mortgage Lending (“Real Estate Debt”): Transactions secured by first lien loans on commercial properties, such as offices, multifamily or industrial properties and located in top markets with strong real estate fundamentals. First mortgage loans are senior in the capital structure, with additional protection from the borrower’s equity and can be structured to provide further principal and yield protection through loan covenants.

Illustrative Example: Real Estate Debt

An institutional investor seeks capital to invest in a commercial real estate property. The property is an office complex located in a large metropolitan city in the U.S., and has financially stable, investment grade companies as tenants. The institutional investor reaches out to an alternative investment manager (the “manager”), typically one they have borrowed from previously, to secure financing. The financing is efficiently priced and structured directly with the institutional investor, resulting in favorable pricing and terms. The result is a high-quality loan negotiated by the manager that generates an attractive and stable coupon with principal protection. The manager negotiates a LIBOR floor, or a minimum rate, which allows the manager to protect against potential decreases in LIBOR.

Alternative Credit: Alternative Credit transactions span public and private markets and are secured by specialty, financial or real assets that generate cash flows upon which the investment relies for repayment. These investments can offer downside protection given ample levels of credit enhancement and robust covenant packages.

Illustrative Example: Alternative Credit

An institutional investor (the “investor”) has existing financing against their diversified portfolio of securities. A bout of market volatility shakes investor sentiment and the traditional lending markets. As a result, the asset manager faces significant liquidity pressures. Through a wide network of relationships, an alternative investment manager (the “manager”) approaches the institutional investor with a refinancing solution. The manager uses their vast resources to underwrite the underlying securities in the investor’s portfolio. The ultimate transaction is a term loan backed by the underlying pool of securities. The loan requires portfolio cash flows be used to repay principal and interest on the loan, has a limited three-year term, and is covenant heavy.

Syndicated Bank Loans (“Bank Loans”): These are transactions where a below investment grade company obtains a loan from an arranger who then syndicates the loan to investors, such as pension funds and collateralized loan obligations (“CLOs”). Bank loans are traded instruments in the liquid portion of the nontraditional credit market, are typically senior secured, and pay a floating rate coupon.

Illustrative Example: Bank Loans

A private equity owned collision repair company seeks financing to fund their merger with an industry peer. The companies are market leaders in the U.S. and look to the capital markets and direct lenders to finance the merger. The company and its private equity owner have an existing relationship with a direct lender which also has a dedicated liquid credit business and multi-billion-dollar bank loan portfolio. The company is able to secure part of their financing package through a deal with the direct lender and their liquid credit business. The remaining portion of the package is arranged and syndicated by a bank. The bank approaches various firms regarding the bank loan and assigns a tight deadline for demand. The manager is able to leverage their multi-year relationship with the company for enhanced diligence and is able to quickly convey demand to the arranger bank. As a result, the manager is able to receive a favorable allocation of the syndicated bank loan.

These asset classes span the liquidity and return spectrum and are typically defensive structures which sit senior in the capital structure. Covenant packages are typical for the illiquid asset classes, though can exist in the liquid markets as well.

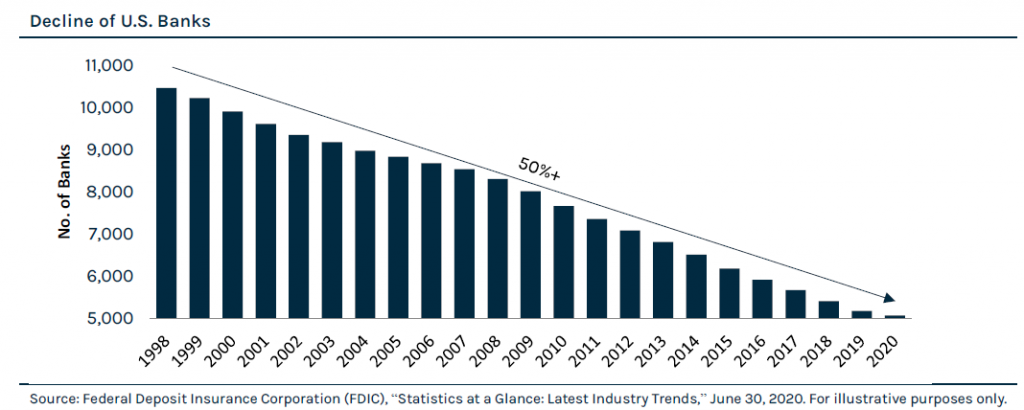

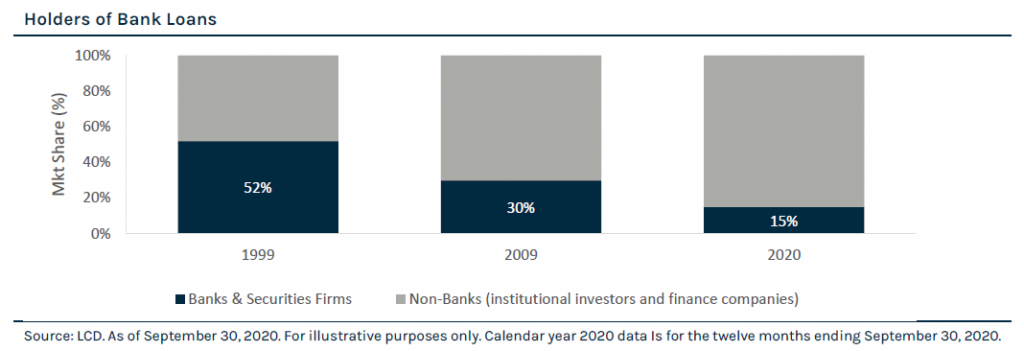

Together, these sources of alternative income represent a vast, multi-trillion-dollar opportunity set. The market opportunity has benefitted from secular trends in the banking industry, notably consolidation and regulatory changes, which has decreased the number of banks as well as their appetite to hold leveraged credit assets. Alternative investment managers have stepped in to fill the void.

Where does this fit in my portfolio?

Even though each market has its own unique traits and nuances, the asset classes within the alternative income universe can generally enhance traditional fixed income and equity portfolios in the following ways:

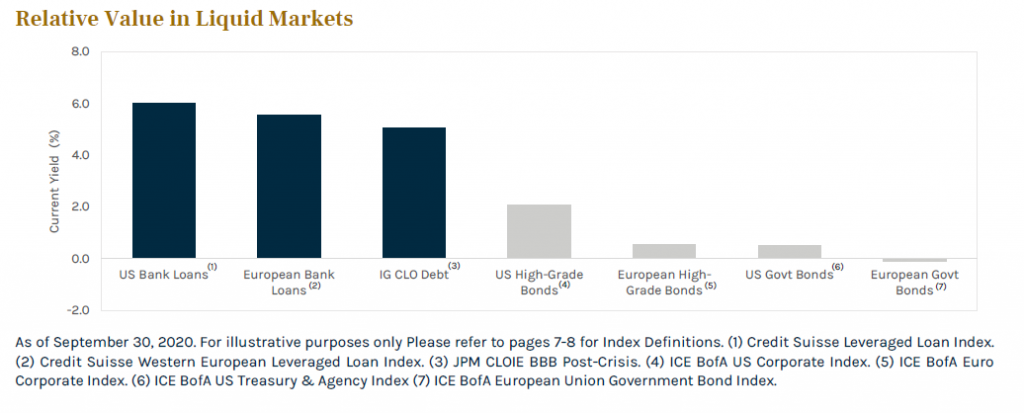

From an income and yield perspective, these assets offer varying premiums relative to traditional fixed income. The below chart provides a tangible example of the current opportunity set in the liquid alternative markets. In the illiquid space additional excess income can also be generated.

Risk and Reward

The benefits of alternative income are not free, and their attractive yields typically come with additional credit risk when compared to traditional fixed income. That said, active managers can mitigate this risk through forensic due diligence and by taking a selective approach to credit allocation. Some managers have been able to successfully execute over time, with low default and loss rates over multiple cycles.

Alternative income assets have demonstrated limited volatility over time. For more liquid markets like bank loans, the attractive income component has contributed to stability and downside protection relative to traditional asset classes. For example, the bank loan market has been a dependable source of positive returns with only two years of negative returns since 20002. The illiquid nature of direct lending, real estate debt and certain forms of alternative credit enhances the already muted asset level volatility exhibited by the liquid assets. An investor’s experience can vary depending on the vehicle used to access these asset classes and the asset allocation mix of the portfolio.

These assets offer limited duration relative to their traditional counterparts as well. Currently, the bank loan market has a duration of 0.91 years compared to 7.27 years for the global fixed income market2, and the weighted average life of illiquid alternative assets are typically 3 years.

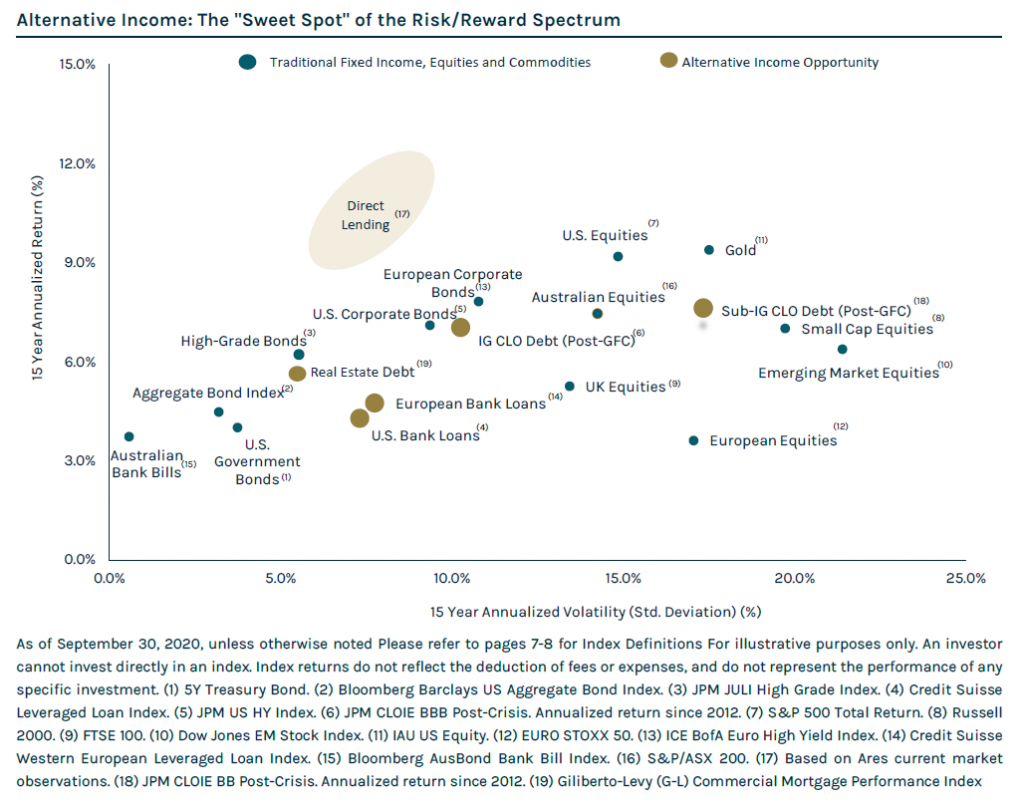

The combination of attractive yields, low duration and defensive structures have contributed to an attractive risk/return profile over time.

We believe these alternative income assets sit in the “sweet spot” relative to traditional asset classes, offering enhanced yields and total returns when compared to traditional fixed income, and limited volatility when compared to public equities. Returns in these alternative asset classes are primarily driven by coupon, but total return opportunities exist in the more liquid markets as trading volatility year-to-date has increased convexity in these markets. The increased volatility has created opportunities where active managers are able to acquire assets at a discount to their face value, creating an opportunity for capital gains.

Conclusion

Alternative income assets can be a reliable source of current income for investors looking to fill the void created by low interest rates and corporate fundamental uncertainty triggered by the COVID-19 pandemic. Specific to credit, these asset classes span the liquidity and return spectrum, though their structures share similar defensive characteristics. We believe these assets sit in the “sweet spot” of the risk reward spectrum, generating attractive returns compared to traditional fixed income and reduced volatility compared to equities. There are a number of synergies between these alternative assets, and we believe managers who have invested heavily in origination and capital markets capabilities can create significant competitive advantages. Additionally, we believe that managers with flexible capital have significant competitive advantages in developing creative solutions across a broader spectrum of opportunities.

Footnotes