Risk Mitigation in the “Sweet Spot” of Credit

Executive Summary

In today’s market environment, where spreads continue to tighten and global yields remain compressed, we believe that allocating to fixed income assets that generate cash yields of 3% to 4% and provide a reliable source of contractual income presents an exciting and compelling relative value opportunity. In order to capitalise on this opportunity, we seek to unearth investment solutions offering higher yields and diversification for Australian investors’ portfolios within certain parts of the global fixed income markets, specifically those that can provide high levels of current income and attractive relative yields with downside protection; we call it the “sweet spot” of credit. This encompasses a $5.0 trillion1 opportunity set across the U.S. and European leveraged loan, high yield, and alternative credit markets.

Keys to Succeed in Investing in the “Sweet Spot” of Credit

- Keen focus on downside protection and capital preservation

- Dynamic, flexible approach to capture the most attractive relative value opportunities

We view the main risks associated with the asset classes in scope to be default risk and price volatility, which are related. The market expectation of default risk increases the credit risk premium, expressed via credit spreads, which can lead to elevated price volatility (all else held equal).

In this short insight piece, we explore the importance of downside protection1 and capital preservation, highlighting how Ares manages default risk and price volatility in an effort to deliver yield enhancement and diversification benefits available to investors in the “sweet spot” of credit.

Default Avoidance

One of the main risks underpinning below investment-grade credit is default risk, which is essentially the risk that a borrower will miss an interest payment or capital repayment, and in a worst-case scenario, go bankrupt.

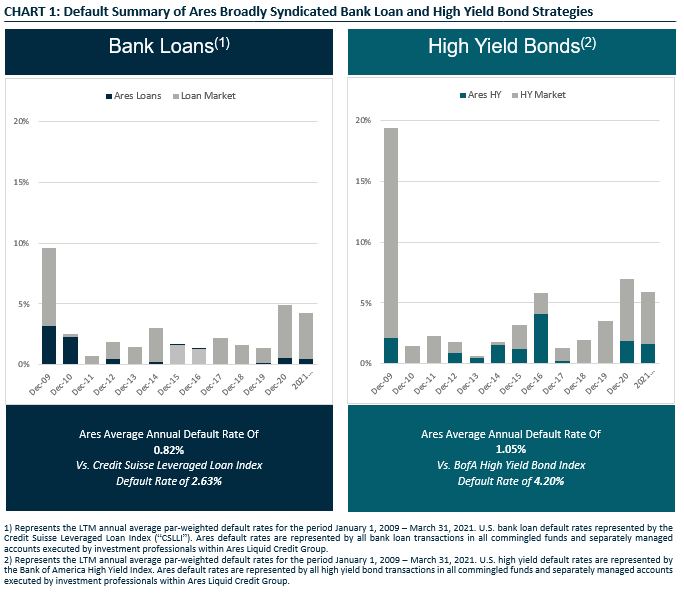

Default risk analysis is fully incorporated into Ares’ investment process, which employs rigorous monitoring of credit performance alongside the robust use of data analytics to identify potential downgrade candidates. This core tenet of Ares’ investment philosophy has resulted in significantly lower defaults in its broadly syndicated bank loan and high yield bond strategies, particularly in periods of dislocation.

At the height of the GFC fall-out in 2009, U.S. bank loan and high yield bond markets saw default rates rise close to 10% and 19%2, respectively, while Ares’ bank loan and high yield strategies experienced default rates lower than 4% and 3% 3 , respectively.

Since its inception in May 2020, the Ares Global Credit Income Fund (“AGCIF”), which invests across the credit asset classes that comprise the sweet spot of credit, has experienced zero defaults4. In comparison, default rates for the U.S. bank loan and high yield bond markets rose to 4% and 6%, respectively, during 2020.2

Managing Volatility Risk

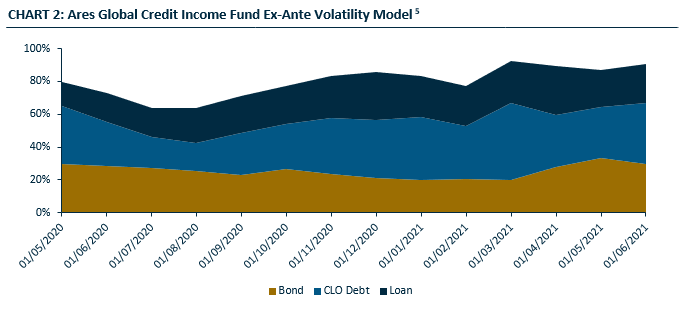

Another key risk when allocating to tradable credit, as opposed to illiquid credit, is volatility risk. Measuring ex-ante risk on leveraged credit is a difficult task, and often overlooked by most risk management systems due to lack of data, particularly in the syndicated bank loan and collateralized loan obligation (“CLO”) markets. Utilising a database of historical daily prices and analytics on 15,000+ bonds, loans and CLO securities, Ares has built and integrated proprietary models that predict ex-ante volatility at the security level, taking into consideration key factors such as credit spread, duration, asset type and issue size, which have proven to be reliable measures of estimating a forward distribution of credit spread levels. These forward-looking distributions are then aggregated up to the portfolio level to measure ex-ante volatility driven by credit risk.

As shown above, the current ex-ante volatility of AGCIF averages approximately 0.8x the volatility of the broader bank loan and high yield bond universe, illustrating our cautious, yet constructive view of the current environment. Further, this demonstrates our ability to generate income without reaching for additional risk. Historically, the volatility of the bank loan and high yield indices has averaged 4-5% and as such, with our current positioning, we expect volatility for AGCIF to average 3-4% while consistently delivering 4% cash yields.

Conclusion

As investors seek returns in a low interest rate world, many find themselves trying to determine how best to allocate to credit to maximize income and mitigate risk. We believe this can be achieved by accessing the “sweet spot” of credit, comprised of corporate and structured credit assets. Importantly, we believe a sharp focus on downside risk is critical to successfully investing across this opportunity set. Driven by insightful credit selection and vigilant risk management, we remain intently focused on finding the most attractive relative value opportunities as we seek to deliver higher yields with optimal downside protection and lower volatility to investors in AGCIF.

1 Source: Credit Suisse Leveraged Loan Index, Credit Suisse Western European Leveraged Loan Index, ICE BofA US High Yield Index, ICE BofA European Currency High Yield Constrained Index, JP Morgan CMBS Weekly: Non-Agency Private-Label, Ares INsight database, and Intex. As of March 31, 2021. Assumes a 1.1723 EUR/USD exchange rate where applicable.

2 Represents the LTM annual average par-weighted default rate. U.S. bank loan default rate is represented by the Credit Suisse Leveraged Loan Index (“CSLLI”). U.S. high yield default rate is represented by the Bank of America High Yield Index (“H0A0”).

3 Represents the LTM annual average par-weighted default rate. Ares bank loan default rate is represented by all bank loan transactions in all commingled funds and separately managed accounts executed by investment professionals within Ares Liquid Credit Group. Ares high yield default rate is represented by all high yield bond transactions in commingled funds and separately managed accounts executed by investment professionals within Ares Liquid Credit Group.

4 Past performance is not indicative of future results.

5 Source: Ares’ proprietary ex-ante volatility model. As of June 1, 2021.

Index Disclosure & Definitions

Index Disclosure: Indices are provided for illustrative purposes only and not indicative of any investment. They have not been selected to represent appropriate benchmarks or targets for the strategy. Rather, the indices shown are provided solely to illustrate the performance of well known and widely recognized indices. Any comparisons herein of the investment performance of a strategy to an index are qualified as follows: (i) the volatility of such index will likely be materially different from that of the strategy; (ii) such index will, in many cases, employ different investment guidelines and criteria than the strategy and, therefore, holdings in such strategy will differ significantly from holdings of the securities that comprise such index and such strategy may invest in different asset classes altogether from the illustrative index, which may materially impact the performance of the strategy relative to the index; and (iii) the performance of such index is disclosed solely to allow for comparison on the referenced strategy’s performance to that of a well known index. Comparisons to indices have limitations because indices have risk profiles, volatility, asset composition and other material characteristics that will differ from the strategy. The indices do not reflect the deduction of fees or expenses. You cannot invest directly in an index. No representation is being made as to the risk profile of any benchmark or index relative to the risk profile of the strategy presented herein. There can be no assurance that the future performance of any specific investment, investment strategy, or product will be profitable, equal any corresponding indicated historical performance , or be suitable for a portfolio. The information related to the various indices is sourced from the providers’ websites. Ares is not responsible for any historic revision made to the indices.

Credit Suisse Leveraged Loan Index (“CSLLI”) is designed to mirror the investable universe of the $US-denominated leveraged loan market. The index inception is January 1992. The index frequency is daily, weekly and monthly. New loans are added to the index on their effective date if they qualify according to the following criteria: 1) Loan facilities must be rated “5B” or lower. That is, the highest Moody’s/S&P ratings are Baa1/BB+ or Ba1/BBB+. If unrated, the initial spread level must be Libor plus 125 basis points or higher. 2) Only fully-funded term loan facilities are included. 3) The tenor must be at least one year. 4) Issuers must be domiciled in developed countries; issuers from developing countries are excluded.

The ICE BofA US High Yield Index (“H0A0”) tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one-year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $100 million. Index constituents are capitalization-weighted based on their current amount outstanding times the market price plus accrued interest. Accrued interest is calculated assuming next-day settlement. Cash flows from bond payments that are received during the month are retained in the index until the end of the month and then are removed as part of the rebalancing. Cash does not earn any reinvestment income while it is held in the index. The index is rebalanced on the last calendar day of the month, based on information available up to and including the third business day before the last business day of the month. No changes are made to constituent holdings other than on month end rebalancing dates. Inception date: August 31, 1986.

Disclaimer

The information in this publication is current as at the date of publication and is provided solely by Ares Management LLC (Ares). Ares is exempt from the requirement to hold an Australian Financial Services Licence. Ares is subject to regulation by the Securities & Exchange Commission of the United States of America under US laws, which differ from Australian laws. None of Ares Australia Management Pty Limited, Fidante Partners Limited, nor any of their associates, has prepared the information in this publication and accept no liability whatsoever in relation to it.

This publication is only made available to ‘wholesale clients’ or ‘sophisticated investors’ under the Corporations Act 2001 (Cth) in Australia.

This publication has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this publication should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting on the advice. Persons receiving this information should obtain and read any disclosure document relating to any financial product to which the information relates before making any decision about whether to acquire that product.

No reliance: This publication is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The publication has not been independently verified. None of Ares, Fidante Partners Limited, Ares Australia Management Pty Ltd, nor any of their respective related bodies corporates, associates and employees, make any republications, warranty or undertaking (express or implied) and accepts no responsibility for the adequacy, accuracy, completeness or reasonableness of the publication or as to the performance of any product. The information contained in the publication does not purport to be complete and is subject to change. No reliance may be placed for any purpose on the publication or its accuracy, fairness, correctness or completeness. None of Ares, Fidante Partners Limited, Ares Australia Management Pty Ltd, nor any of their respective related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the publication or otherwise in connection with the publication. Any forward-looking statements in this publication: are made as of the date of such statements; are not guarantees of future performance; and are subject to numerous assumptions, risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Ares undertakes no obligation to update such statements. Past performance is not a reliable indicator of future performance.

Confidentiality and intellectual property: This publication is confidential and may not be copied, reproduced or redistributed, directly or indirectly, in whole or in part, to any other person in any manner.

Risk: no person guarantees the performance of, or rate of return from, any product or strategy relating to this publication, nor the repayment of capital in relation to an investment in such product or strategy. An investment in any such product or strategy is not a deposit with, nor another liability of, Ares, Fidante Partners Limited, Ares Australia Management Pty Ltd nor any of their respective related bodies corporates, associates or employees. Investment in any product or strategy relating to this publication is subject to investment risks, including possible delays in repayment and loss of income and capital invested.

REF: AAM-00154

Disclaimer – Fidante Partners

Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante) has entered into arrangements with Ares and Ares Australia Management Pty Ltd ABN 51 636 490 732 (AAM), in connection with the distribution and administration of financial products managed by Ares or AAM. In connection with those arrangements, Fidante or AAM may receive remuneration or other benefits in respect of financial services provided by the parties. Neither Fidante nor AAM are responsible for the information in this material, including any statements of opinion. AAM is an Authorised Representative No. 001280423 of Fidante and is in the process of seeking its own Australian financial services licence.

Ares is exempt from the requirement to hold an Australian Financial Services Licence. Ares is subject to regulation by the Securities & Exchange Commission of the United States of America under US laws, which differ from Australian laws. None of Ares Australia Management Pty Limited, Fidante Partners Limited, nor any of their associates, has prepared the information in this publication and accept no liability whatsoever in relation to it. This publication is only made available to ‘wholesale clients’ or ‘sophisticated investors’ under the Corporations Act 2001 (Cth) in Australia.

Related Insights

Top performing funds: This income fund returned 13.7% in FY24 to be one of Australia’s best

Livewire | Income is back – and credit gives you the best seat in the house